Libya: A New Frontier for Natural Gas

Following over a decade of turmoil since the 2011 civil war, Libya still finds itself divided. In a country known for its crude-based economy, there’s another silver lining that’s less talked about: natural gas. With the fifth-largest proven gas reserves in Africa, around 53 trillion cubic feet, Libya is once again attracting international investors and Western governments looking to diversify their supply.

This realignment is one aspect of the greater rebalancing of the West’s, namely European, energy policy. Ever since the energy squeeze stemming from the Ukraine War, Libya’s geographic and geopolitical position has become increasingly relevant.

A Strategic European Energy Partner

The terms of Europe’s energy equation have been radically changed. In its attempts to diversify geographically, the European Union has looked south towards North Africa.

Italy, in particular, has led the way. In 2023, Italian energy giant Eni signed a groundbreaking gas deal with Libya’s National Oil Corporation (NOC), marking the country’s largest energy investment in over two decades. According to Eni’s official statement, the agreement targets the development of two offshore gas fields with production slated to begin by the end of 2026.

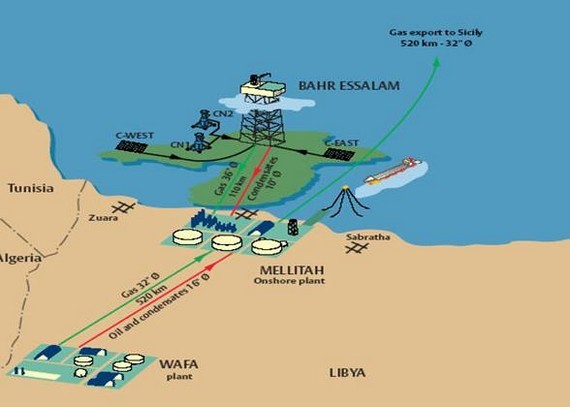

Infrastructure is already partially in place. Since 2004, The Greenstream pipeline, a 520-kilometer undersea connection, has been carrying natural gas from Libya’s Mellitah complex to Sicily. Despite production via Greenstream fluctuating due to Libya’s domestic conflict, the pipeline provides a direct and strategic energy connection between North Africa and Europe.

Untapped Reserves, Undeniable Potential

Despite its large reserves, Libya’s natural gas sector remains underdeveloped. Production is dominated by two giant fields, the offshore Bahr Essalam and the onshore Wafa field, both operated by Mellitah Oil & Gas Company, a joint venture between Eni and the NOC.

Eni announced that they’re launching the “Structures A&E” project, a strategic plan to boost both domestic gas supply and exports. Production is expected to start from the end of 2026 and will reach up to 750 million cubic feet per day when fully operational, according to the company.

Much of Libya’s promise remains dormant beneath its seabed and soil due to decades of infrastructural decline and underinvestment. But with foreign firms showing interest again, there is cautious optimism that this could change.

According to the International Energy Agency (IEA), there’s a need for an increase in natural gas supply to meet the rising demand. Libya, with its proximity to Europe and abundant reserves, is best positioned to provide some of that demand. There’s also the environmental element which makes the market all the more appealing. As Europe aims to reach its net-zero goals and developing countries seek a replacement for coal, natural gas—which emits less carbon than traditional fossil fuels—plays a role in the transition to cleaner energy.

Political Will and Strategic Vision

While Libya remains divided between the east and west, there does appear to be a growing consensus regarding the importance of natural gas.

Last year, Oil and Gas Minister Khalifa Abdelsadek claimed that the country plans to raise its natural gas production from 2.5 billion cubic feet per day to 4 billion cubic feet per day. Abdelsadek stressed that the country intends to shift its crude oil-based economy to include natural gas as well. It would require enormous international coordination and expansion of existing plants, but it indicates ambition.

Ambition, however, must be balanced with reality. Libya’s domestic issues and lack of regulatory stability do pose some risk to investors. Ongoing civil unrest and facilities being targeted by militias remains a threat to cause disruption.

There are positive signs of confidence, though, and as Libya slowly emerges from the darkness of conflict, natural gas could be an economic engine and a catalyst for greater international engagement. With European competition for substitutes fierce and Libyan leadership suggesting a willingness for openness and a desire for ambition, the potential for an industry boom certainly exists.